2021 Tax Updates

__________________________________________________________________________________________________________________

Currently this is only for 2021, however it may continue to future tax years.

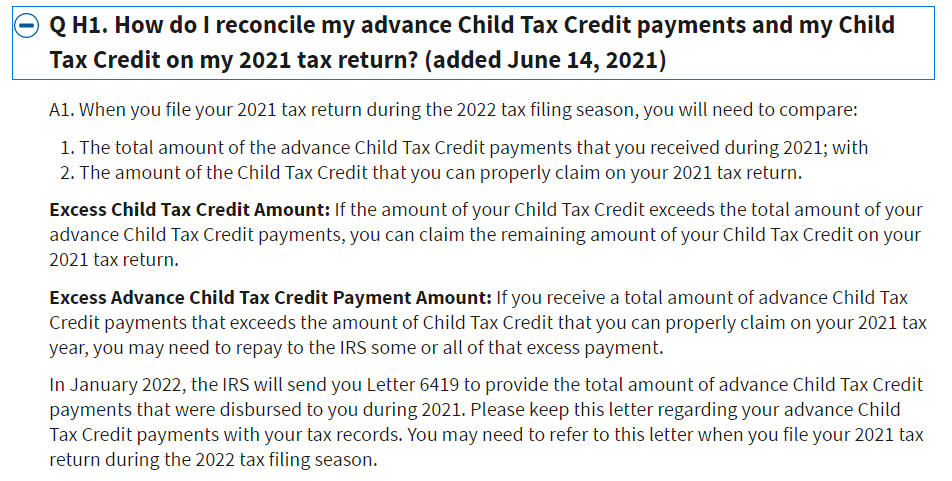

If your adjusted gross income (line 11 of your 2020 tax return) was under $400,000 Married filing jointly or $200,000 for Single or Head of Household,

you received a tax credit of $2,000 per child up to age 17.

For 2021, if your adjusted gross income is less than the following amounts:

- $150,000 Married Filing Jointly

- 112,500 Head of Household

- $75,000 Single or Married filing separately

You will get a tax credit of – $3,600 for a child 5 or younger or $3,000 for child age 6-17

The US legislature has decided to pay you ½ of this credit in advance on a monthly basis starting July 15, 2021, because of COVID.

If you decide that you do not want this paid to you until your tax return is done in early 2022 – then you have the option to opt out of the advance payment.

You will need to set up an account on irs.gov to make adjustments or execute the opt-out option.

The link to opt out of the advanced payments is on the IRS website:

Advance Child Tax Credit Payments in 2021 | Internal Revenue Service (irs.gov)

Other information such as adding children adopted or born in 2021 are available on this IRS website link:

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

Please call our office with any questions.